Turning Points for Labor and Housing?

The labor sector delivered plenty of news for the markets to digest, including some important signals about what may be ahead. Plus, the latest on home prices, manufacturing and more in these stories:

- Mixed Jobs Report for March

- Disappointing Private Sector Job Growth Signals “Slowing” Economy

- Reporting Adjustment Sheds Light on Unemployment Claims

- Home Price Forecast Sees Upward Revision

- Recession-like Conditions Continue in Manufacturing

Mixed Jobs Report for March

The Bureau of Labor Statistics (BLS) reported that there were 236,000 jobs created in March, which was in line with estimates. Revisions to the data from January and February subtracted 17,000 jobs in those months combined, which tempers March’s gains a bit. The unemployment rate fell from 3.6% to 3.5% even as the labor force increased.

What’s the bottom line? Despite the strength in these headline points, a deeper look at the data shows some signs of weakness in the labor market.

Leisure and hospitality accounted for 72,000 new jobs in March. This sector has been a huge driver of job gains after the massive losses seen during the height of the pandemic. However, 98% of these jobs have now been regained so they may not contribute to the overall total for much longer. In fact, the latest Job Openings and Labor Turnover (JOLTS) report showed a sizable drop in leisure and hospitality job openings over the last two months.

In addition, while average hourly earnings were up 4.2% year over year in March, this is a decline from 4.6% and the lowest post-COVID yearly increase we have seen. Average weekly earnings were only up 3.3% year over year, which is also a big drop from the previous two reports.

It also appears that some companies are cutting hours to save costs, which is another sign of a slowing labor market. The average workweek fell from 34.5 hours to 34.4 hours, the lowest number of hours worked since 2019 (excluding COVID). While this doesn’t sound like a large decline, it reflects the entire US workforce of 161 million workers whose hours were cut by a tenth of an hour on average. This reduction in hours equates to 468,000 job losses.

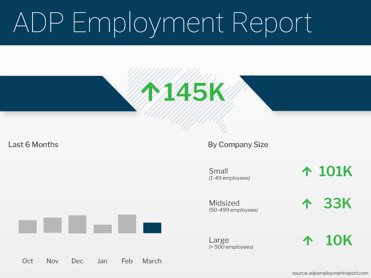

Disappointing Private Sector Job Growth Signals “Slowing” Economy

Private payrolls were below estimates last month, as the ADP Employment Report showed that there were just 145,000 jobs created in March. Annual pay for job stayers increased 6.9% and job changers saw an average increase of 14.2%. These figures are still high but they have been moderating, showing lower wage-pressured inflation.

While the leisure and hospitality sector once again led the way with 98,000 job gains, these jobs may not bolster the overall private payroll total for much longer, as noted above.

What’s the bottom line? Nela Richardson, chief economist for ADP, said, “Our March payroll data is one of several signals that the economy is slowing. Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down.”

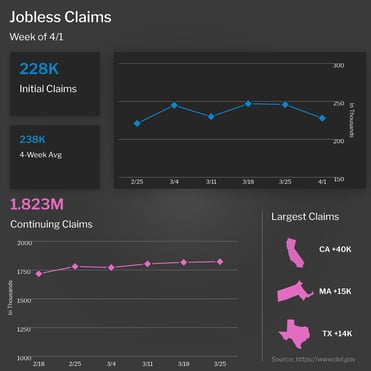

Reporting Adjustment Sheds Light on Unemployment Claims

Initial Jobless Claims fell by 18,000 in the latest week, as 228,000 people filed for unemployment benefits for the first time. However, this does not tell the whole story. The previous week’s data was revised higher from 198,000 to 246,000 due to methodology adjustments, as explained below.

The number of people continuing to receive unemployment benefits after their initial claim is filed also rose 6,000 to 1.823 million. There is more to this figure as well, with the prior week being revised higher from 1.689 million to 1.817 million.

What’s the bottom line? The Bureau of Labor Statistics has revised the seasonal adjustment factors they were using to compile the Jobless Claims report now that they have a better understanding of how COVID impacted the numbers in recent years. This has caused a material change in many of the previous reports over the past five years, making the number of Initial and Continuing Claims MUCH higher. These revisions paint a very different labor market picture than previously reported.

In addition, the Job Cuts Report from Challenger, Gray & Christmas showed that there were 90,000 job cuts in March, which is 15% higher than February. The technology sector led the way, accounting for 38% of the total. The report also noted that market and economic conditions, cost-cutting, and unit or department closings are the biggest reasons for job cuts made this year.

Home Price Forecast Sees Upward Revision

CoreLogic’s Home Price Index showed that home prices nationwide rose by 0.8% from January to February and they were 4.4% higher when compared to February of last year. This annual appreciation reading declined from 5.5% in January but is still solid. CoreLogic forecasts that home prices will rise 0.2% in March and 3.7% in the year going forward, which is an upward revision from 3.1% in January’s report.

What’s the bottom line? CoreLogic’s Chief Economist Selma Hepp said that “U.S. home prices rose by 0.8% in February, double the month-over-month increase historically seen and indicating that prices in most markets have already bottomed out.” She also noted that “pent-up homebuyer demand is responding favorably to lower rates in many markets.”

On a related note, Black Knight’s latest Mortgage Monitor Report showed that home prices rose 0.2% in February, which is the first monthly gain since they peaked last June. Prices are now down just 2.6% from their peak, a far cry from a housing crash of 20% that some in the media have been predicting.

Recession-like Conditions Continue in Manufacturing

Economic activity in the manufacturing sector remained in contraction territory for the fifth straight month, as the ISM Index was reported at 46.3% for March. This data is compiled from a survey of purchasing and supply executives nationwide and measures the health of the manufacturing sector in the U.S. March’s reading was below expectations and saw new orders and production both contracting. Generally, readings above 50% indicate that the manufacturing economy is expanding, while below 50% signals a decline.