Media Singing Wrong Tune About Housing

Consumer inflation is trending lower in the right direction, while data shows the housing market is stronger than media reports suggest. Here are last week’s highlights:

- Annual Consumer Inflation Continues to Move Lower

- Signed Contracts Show Housing Is Standing Strong

- Media Cries Housing Crash but Appreciation Data Says Otherwise

- Significance of Elevated Continuing Jobless Claims

- What Do GDP Forecasts Signal?

Annual Consumer Inflation Continues to Move Lower

The Fed’s favorite measure of inflation, Personal Consumption Expenditures (PCE), showed that headline inflation increased 0.3% in February, while the year-over-year reading fell from 5.3% to 5%. Both readings were just below market estimates. Core PCE, which strips out volatile food and energy prices, also rose by 0.3% with the year-over-year change declining from 4.7% to 4.6%.

What’s the bottom line? Inflation is the arch enemy of fixed investments like Mortgage Bonds because it erodes the buying power of a Bond's fixed rate of return. If inflation is rising, investors demand a rate of return to combat the faster pace of erosion due to inflation, causing interest rates to rise like we saw throughout much of last year.

Inflation continues to trend lower in the right direction, though last month’s reading would have been even lower if the decelerating shelter costs seen in the real world were better reflected in the PCE report. Once this lagging shelter data catches up in the PCE report, it should cause additional downside pressure to inflation.

Signed Contracts Show Housing Is Standing Strong

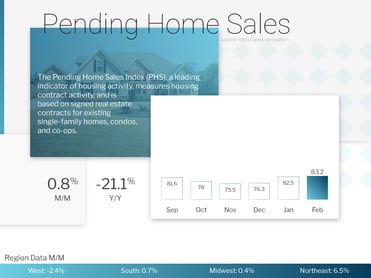

Pending Home Sales rose 0.8% from January to February, which was much stronger than expectations and marks the third straight month of increases. Sales were down 21.1% from a year earlier, though this was an improvement from the 24.1% annual decline in January’s report. Pending Home Sales is a critical report for taking the pulse of the housing market. It is considered a forward-looking indicator of home sales because it measures signed contracts on existing homes, which represent around 90% of the market.

What’s the bottom line? Lawrence Yun, chief economist for the National Association of REALTORS®, noted, “After nearly a year, the housing sector’s contraction is coming to an end. Existing-home sales, pending contracts and new-home construction pending contracts have turned the corner and climbed for the past three months.”

Housing activity should continue to rebound during the spring buying season, especially if home loan rates move lower and hibernating buyers are motivated to resume their home search.

Media Cries Housing Crash but Appreciation Data Says Otherwise

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices declined 0.5% from December to January but they were 3.8% higher when compared to January 2022. This annual reading is a decline from the 5.6% gain reported in December.

The Federal Housing Finance Agency (FHFA) also released their House Price Index, which revealed that home prices rose 0.2% from December to January. While prices rose 5.3% from January 2022 to January 2023, this was a decline from the 6.6% annual increase reported in December.

These figures differ in part because FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans.

What’s the bottom line? Home prices have been softening nationwide, but S&P DJI Managing Director Craig J. Lazzara noted that they are only down 5.1% from their peak last June. Plus, when you adjust for seasonal factors, prices are only down 3% from the peak. This is a far cry from a housing crash of 20% that some in the media have been predicting.

Significance of Elevated Continuing Jobless Claims

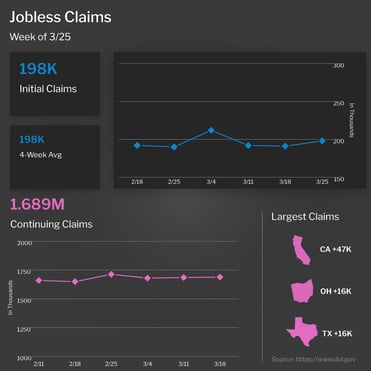

The number of people filing for unemployment benefits for the first time rose by 7,000 in the latest week, as 198,000 Initial Jobless Claims were reported. The number of people continuing to receive unemployment benefits after their initial claim is filed also rose 4,000 to 1.689 million. Note that the number of Continuing Claims can be volatile from week to week. However, the overall trend has been higher, as they have now risen by nearly 350,000 since the low reached last September.

What’s the bottom line? While it’s true that Initial Jobless Claims remain under 200,000, which is a relatively muted level, it’s important to understand that this is a lagging indicator regarding the strength of the labor market. Think of it this way. As the economy slows, companies don’t typically hold layoffs right away. Instead, they usually slow their pace of hiring first, potentially implementing hiring freezes before making the difficult decision to let people go. The elevated level of Continuing Claims suggests companies have reduced their pace of hiring and it’s harder for people who are let go to find new employment.

What Do GDP Forecasts Signal?

The final reading of fourth quarter 2022 Gross Domestic Product (GDP) showed that the U.S. economy grew by 2.6%, which is a downward revision from the first (2.9%) and second (2.7%) readings. Still, seeing GDP turn positive in the third and fourth quarters of last year was a welcome sign, since it was negative for the first two quarters of 2022.

What’s the bottom line? Given that GDP functions as a scorecard for the country’s economic health, the big question now is what will GDP be for the first quarter of this year? The initial reading will be released April 27 and as of now the markets are expecting a reading of 3.2%. However, the Fed’s estimate for full year 2023 GDP is just 0.4%. If the Fed’s forecast is accurate, GDP would likely turn negative for the remainder of the year, which could signal recession.