Finding Success in a Vulnerable Time

By: Megan Anderson, VP of Publicity

The end of the year is a perfect time to reflect on the past and plan for the future. Yet, the current market has caused a great deal of fear and worry for many of us.

Rates are almost 4% higher than they were a year ago, while the Fed’s hikes to the Fed Funds Rate and uncertain economic conditions have only added to the volatility in the markets and mortgage rates. This has caused many would-be homebuyers to delay their purchase.

As a result, the Mortgage Bankers Association (MBA) is expecting total mortgage origination volume to decline to $2.05 trillion in 2023 from the $2.26 trillion anticipated in 2022. Purchase originations are forecast to decrease by 3% to $1.53 trillion next year, while refinance volume is expected to decline by 24% to $513 billion.

This could mean less money in our pockets and harder deals to come by. Many companies are also feeling the slowdown and we’re being bombarded with headlines and fears of pay cuts and layoffs.

But there is still reason to say cheers to our success!

Later in this blog, I will highlight MBS Highway’s market and inflation forecasts which will indeed make you want to say cheers to the future. But for now, I wanted to remind you that these cycles are a natural part of this business.

Success is a choice and the strong will not only survive but thrive.

A Powerful Reminder

I recently finished reading Christine Beckwith’s new book, “Finding Honor: The Journey to Truth,” where she shares her story of going through one of these cycles during the housing crash of 2006 through 2008. She had just become the VP of Sales at H&R Block Mortgage.

For more than a decade, Christine had worked toward this opportunity, taking her team from last place to first place. Little did she know the mortgage industry was about to crash. After spending years building her team, she now had to downsize and lay off the very people she had spent years cultivating and believing in when no one else did.

Circumstances like this – and like the current environment we’re in – can make it challenging to see anything but pain. It can be easy to stay in the habit loop of “poor me” or “it’s the Fed’s fault.” But here's the thing. Staying in this mindset isn’t going to lead you to success. It’s the fast track to a “slow death,” as Christine puts it.

It’s a victim mindset.

I want to highlight the outcome of Christine's experience because I think that it teaches us a very important lesson: It’s up to us to choose happiness.

Christine said, “Years after this traumatic career intersection, I understood going through this tumultuous time was how I earned my true executive leadership wings. Until you lead in down-turned markets, you have not yet experienced leadership. Until you have had to give hope during hard times, give continued strength during bad markets, keep folks focused, and at work with a winning mindset despite taking losses, you don’t know the depth of leadership.”

I’m in a unique position where I hear a lot of stories and challenges that many of you are currently facing, and Chrstine’s insights are so valuable for leaders today, from branch managers to C-level executives.

Plus, there are reasons to say cheers to your success and to the future. First, I’ve seen a lot of people give up and leave the business. You should cheer to the fact that you’re staying strong while learning to navigate this market. Markets like the one we’re in today shed dead weight while those who are committed hang in there. They see the bright side to come and capitalize on the business of those originators who left.

Where Are the Markets Headed?

Speaking of the bright side to come, a large reason mortgage rates have moved higher this past year is due to inflation. In order to understand the future of the market, we must understand inflation.

Inflation is the arch enemy of fixed investments like Mortgage Bonds because it erodes the buying power of a Bond's fixed rate of return. If inflation is rising, investors demand a rate of return to combat the faster pace of erosion due to inflation, causing interest rates to rise as we’ve seen this year. In other words, inflation is going to drive mortgage rates.

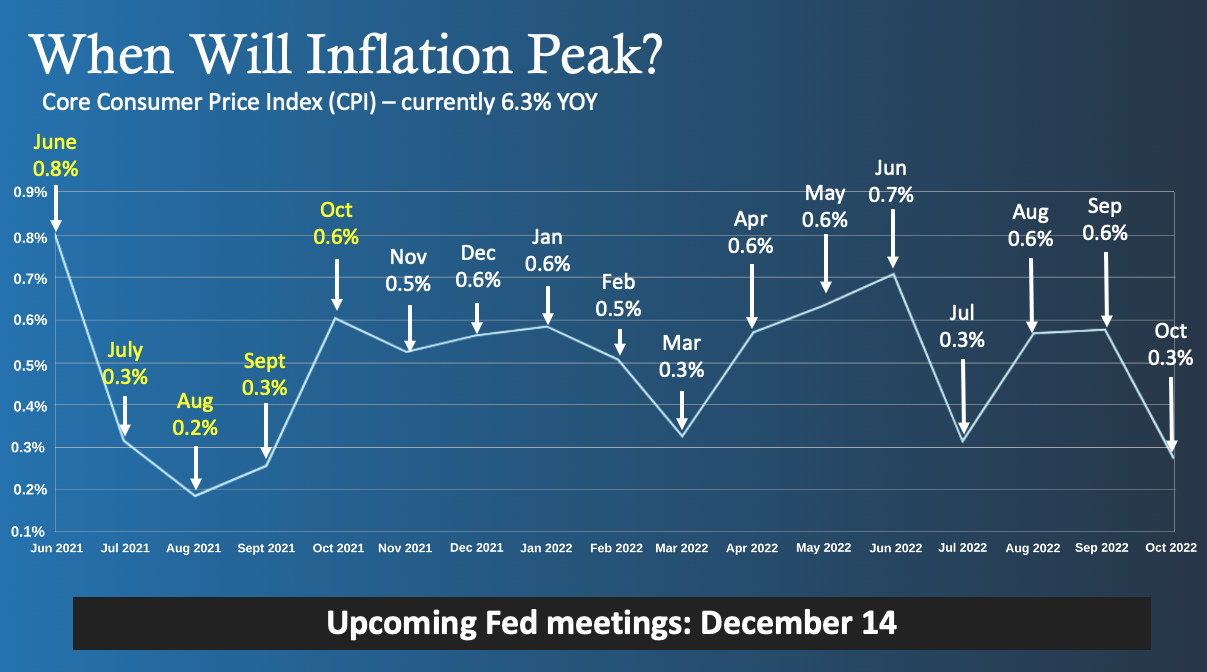

One report we look at to measure inflation is the Consumer Price Index (CPI). CPI has two main components: Headline Inflation (overall inflation) and Core Inflation, which strips out volatile food and energy prices. In addition, inflation is calculated on a rolling 12-month basis, which means that the total of the past 12 monthly inflation readings will give us the year-over-year rate of inflation.

The MBS Highway team had circled November 10 as a crucial date for some time, as this marked the release of October’s CPI data. For months, we explained that we felt this report would mark the start of a deceleration in inflation, which would in turn bring a moderation in mortgage rates.

Looking at the graph below for Core CPI, you’ll notice we were correct in our thinking. Core CPI for October 2021 was elevated at 0.6% and it was replaced with a much lower reading of 0.3% for October 2022, causing year-over-year Core CPI to move lower from 6.6% to 6.3%. This decline should continue as we replace the readings for November, December, January and February, all of which are elevated.

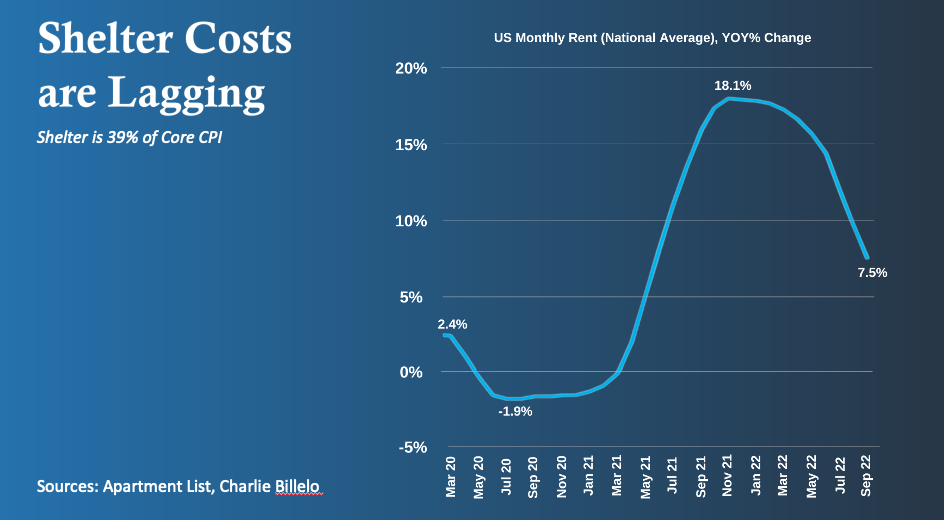

In addition, the Fed’s hikes to its benchmark Fed Funds Rate are finally starting to slow down the economy, helping to curb inflation and moderate mortgage rates. Plus, shelter costs make up 39% of Core CPI and they saw their largest monthly increase in the history of the index in October, meaning they played a big role in the monthly gain. However, they have been lagging in the CPI report.

In more real-time data, we are seeing a moderation in rental prices. Below you’ll see a graph from Apartment List, showing that year-over-year rental prices peaked last fall at 18.1% and have since moderated to being up 7.5% year over year. These moderating shelter costs should be reflected in the CPI data hopefully by January, which should add additional downside pressure to inflation.

It is not out of the question to see rates in that 5% arena in the first part of next year, maybe a little bit above, maybe a little bit below. But better times are ahead. I want you to stay optimistic.

MBS Highway’s modeling is working, and you can stay up to date by watching our daily morning update video where we break down all the housing and economic news. Take a free 14-day trial of MBS Highway and learn more about how our daily coaching videos, lock alerts, financial calculators, loan comparisons and more can help you better serve your clients and grow your business now and for years to come.

What our modeling shows is that the housing market has really tight inventory and household formations have slowed because people are hibernating in this 7% rate environment. But because of this inflation picture which drives mortgage rates, we should see rates decline into the 5% area as inflation continues to decline. When this happens, we are going to see a slew of buyers unleashed into a tight inventory environment.

But that doesn’t mean your clients need to wait for rates to come down to purchase a home, especially since they may have to deal with stiff competition. Now might just be the opportunity you’ve both been waiting for.

The Opportunity You’ve Been Waiting For

Not too long ago, the housing market was on fire. Buyers often had to bid above asking price among multiple offers and many even waived inspections and bought a home sight unseen. Now buyers have more negotiating power and instead of just getting a price reduction, they can ask the seller to contribute towards a 2/1 buydown or a permanent buydown. You can use MBS Highway’s 2/1 buydown and Seller Contribution tools to help illustrate what option might be best for your clients. Watch this video to learn more.

Lastly, I want you to take a moment to be proud of your success right now. Even if your volume isn’t where it was last year, say cheers to the simple truth that you are a fighter, you are keeping a positive mindset and riding out the storm. And when we get to the first quarter and especially the second quarter of next year, we can say cheers to lower rates and an influx of potential buyers.