Recently, Business Insider published an article titled, “Buckle in for a brutal free-fall in home prices and US housing is in a massive bubble,” in which experts shared their beliefs about what’s coming next for the housing market. Let’s dissect their commentary and compare it to what’s really going on.

Jeremy Siegel, Wharton professor of finance, explained that he expects home prices to drop by “10% to 15%” while Mark Zandi, chief economist at Moody’s Analytics, believes national home prices will fall “almost 10% peak-to-trough.” Veteran economist David Rosenberg said that “we have a massive housing bubble right now” and Ian Shepherdson, chief economist at Pantheon Macroeconomics, noted he expected “a drop of 15-to-20% over the next year.”

A 20% decline in home prices would be a doomsday-like scenario, and something similar to what we saw during the housing bubble, as home prices declined by 20% from their peak in 2007 to the trough in 2009.

And while some experts are predicting a similar type of crash is ahead, it’s important to understand that the supply and demand dynamics are very different today.

Back in 2007, there were 4 million homes for sale versus just 1.22 million today. Builders were also putting up record numbers of homes while demand was falling. Today, demand is waning, but builders have learned their lesson from a decade ago. Housing Starts for single-family homes declined 20.8% from October of last year, while single-family Building Permits (which are indicative of future supply) fell 22.1% year over year.

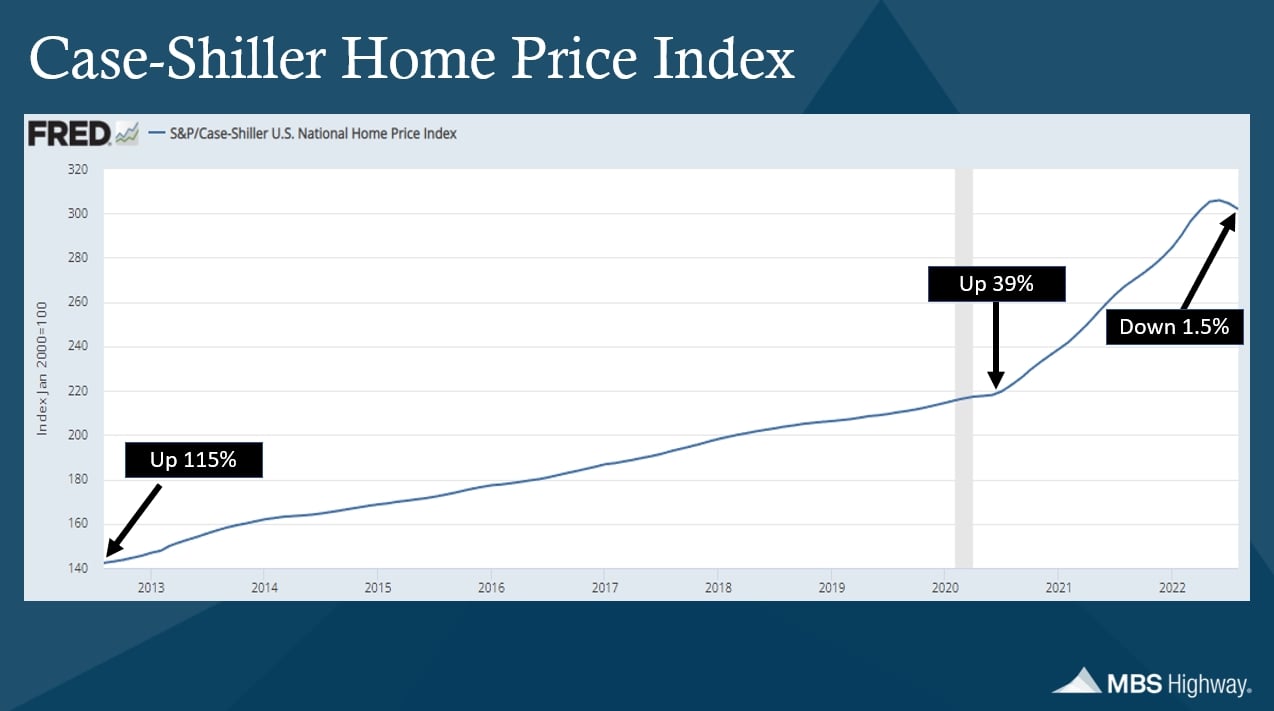

In addition, while Case-Shiller is reporting that home values nationwide have come down 1.5% from their peak, it’s important to look at this data in context. As you can see in the chart below, home prices have risen 115% over the last ten years. And in the last two years alone, when so many people in the media were negative about the housing market, prices were up 39%.

Note that the Case-Shiller data is lagging two months, with September’s figures released on November 29 showing that home prices fell 1% from August to September. While further softness in home prices is possible in the next several Case-Shiller reports due to the rise in mortgage rates seen earlier this fall, it will not be remotely close to the 20% decline that some have predicted given the current supply and demand dynamics.

In fact, Case-Shiller’s report showed that home prices were still 10.6% higher than compared to September of last year. The main point here is this. We are still seeing home price appreciation on a year over year basis.

In addition, remember that inflation is the main driver of mortgage rates. Inflation is calculated on a rolling 12-month basis, which means that the total of the past 12 monthly inflation readings will give us the year-over-year rate of inflation. For example, when the data for November 2022 is released this month, it will replace the data for November 2021 in the calculation of annual inflation.

Going forward, the inflation readings that will be replaced are much higher, so if we see lower monthly readings like we did in October’s report, the annual rate of inflation will continue to move lower. Again, lower inflation typically helps both Mortgage Bonds and mortgage rates improve.

In the first half of next year, rates are forecasted to move down to 5% due in large part to lower inflation. As a result, many buyers that are currently hibernating due to high rates will likely resume their home search.

And given the current low supply environment, we could actually see a reacceleration in home prices – not the doomsday crash so many in the media would have you believe.

Do you want analysis like this on a daily basis?

MBS Highway can help!

Investing in an MBS Highway membership – where you'll have access to our daily morning update video featuring analysis on the markets and economic data as well as tools like our Bid Over Asking Price, Buy vs. Rent Comparison, Loan Comparison, lock alerts and more – means you'll have everything you need to turn prospective homebuyers into clients and become the type of advisor they need to guide them in today's market and for years to come.

Take a free 14-day trial of MBS Highway and see for yourself how we can help you grow your business.