MBS Highway’s monthly Housing Index survey provides a near real-time read on the activity and pricing pressures in the housing market, helping mortgage loan originators to better serve homebuyers.

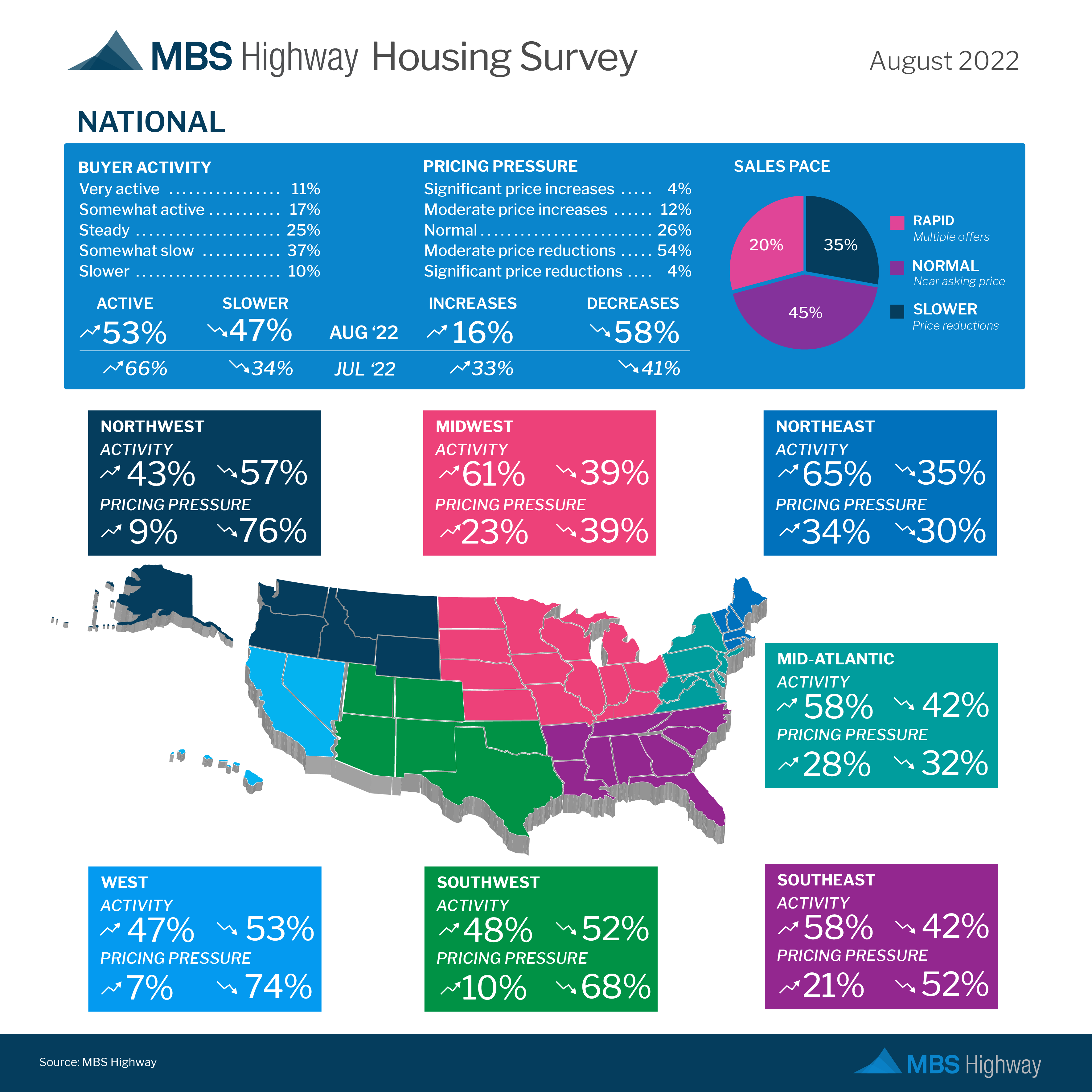

HOLMDEL, NEW JERSEY, August 18, 2022 – Earlier this month, MBS Highway surveyed over 2,500 mortgage and real estate professionals around the country regarding current housing market conditions. The results for the August 2022 release showed that while there is certainly a slowdown in activity and pricing pressure from July to August, 53% of respondents said their market is still “steady to very active.” This is compared to 66% of respondents in July.

In terms of pricing pressure, 16% of those surveyed are still seeing “moderate to significant” price increases versus 33% in July. While 58% are seeing some degree of price reductions (as compared to 41% in July), respondents noted that many of these are listing prices that are coming down to more appropriate levels and not home value declines.

Regarding the pace of sales this month, 45% are seeing normal levels with homes selling near the asking price (a slight rise from 40% in July), while 20% reported that the pace of sales remained rapid with multiple offers (versus 37% in July). The number of respondents reporting a slower pace of sales with price reductions rose from 23% in July to 35% in August.

Regional Highlights

Buyer activity remained steady to very active in August in the Mid-Atlantic (58%), Southeast (58%), Midwest (61%) and Northeast (65%), though these figures have come down from July. In other parts of the country, respondents were more likely to describe buyer activity in their markets as “somewhat slow” or “slower” this month, including 52% in the Southwest, 53% in the West, and 57% in the Northwest.

Moderate to significant price reductions were seen more in the Western part of the country, as noted by 68% of respondents in the Southwest, 74% in the West and 76% in the Northwest.

A normal to rapid sales pace with homes selling either near asking price or quickly with multiple offers remained the norm in much of the middle and Eastern parts of the country, with 75% of respondents in the Southeast, 83% in the Midwest, 87% in the Mid-Atlantic and 88% in the Northeast describing their markets in this manner. However, once again these figures have decreased from July.

About MBS Highway’s Housing Index Survey

MBS Highway’s monthly Housing Index survey provides an accurate and near real-time representation of buyer activity, pricing pressure, and the pace of sales both regionally and nationally across the country. The survey fills a crucial industry need for insights that reflect buyers’ immediate experiences, helping mortgage loan originators to better serve homebuyers.

Dan Habib, Executive Vice President for MBS Highway, explained, “There are a few reliable housing reports available in the market, most of which are delayed by two months. Because MBS Highway has over 35,000 mortgage and real estate clients, we felt we were in a unique position to capture real-time regional housing data from our subscribers, who are on the front lines of the housing market.”